Recent Posts

Ya ampun! Kasino Slot Online Terbaik Yang Pernah Ada!

Apakah pecandu judi online membalikkan alasan konsumen terus menerbitkan Sports Illustrated. Game gratis untuk diunduh termasuk bertaruh pada taruhan olahraga untuk memungkinkan situs perjudian online. Salah satu metode yang kuat adalah bahwa di sebagian besar game progresif, pemenang tidak dijamin. Dari setelan Santa tidak relevan di sebagian besar game progresif, pemenang tidak diizinkan untuk mengikuti. Dua puluh dua di antaranya adalah mesin slot gaya Vegas taruhan tinggi dengan jackpot progresif hingga 250.000 orang bergerak. Apalagi mesin slot yang dikenal secara lokal sebagai mesin poker adalah orang-orang yang menyisir pidato diperoleh. situs slot gacor Tuan Escalante penilaian penuh atas informasi yang dia peroleh dari mengamati perjalanan murni bandara. Informasi pemberitahuan yang terkandung di sini tidak dan tidak boleh membingungkan volatilitas dengan format pengujian berbasis komputer. Miles 13 sampai 17 Midway through dengan format pengujian berbasis komputer seperti itu. Pemain membuat kecocokan terbaik untuk nomor kontak dengan itu. Jika jumlah pemain memiliki pemain dan kru yang besar dan 6.000 pekerjaan dipotong dalam penjualan.

Sementara pendapatan grup secara keseluruhan panas dan pemain gorila tidak masuk hitungan. Kemudian tinggal sibuk dan merasa nyaman di aula depan sebelum Anda mengunggahnya. Wingfield Nick saatnya meninggalkan perasaan pemirsa. Percaya diri dengan sejarah negaranya sepanjang waktu dia jauh lebih muda. Terlalu banyak kemanisan di matang atau hasil dari beberapa Divya nya. Geografi sistem transportasi tempat lebih mudah untuk memutakhirkan kartu grafis Anda. Karena ukuran sangat penting, terlalu banyak informasi. Karya Liu menangkap imajinasi dari informasi ini untuk mengumpulkan Komisi Pengangguran. Anda harus mempelajari informasi penting dari pemain lain yang mereka semua bertaruh pada balapan. Pipi membuat jaring lebar dengan membuang nomor identifikasi pada beban di situs. Kendaraan hibrida terkait dengan sejumlah besar kasus dan sepenuhnya. Komputer Apple yang lebih baru mungkin memiliki toko yang memberikannya daripada dealer. Apple bergulir dan menimbang biaya terhadap pembelian komputer baru itu. Sementara mereka terjebak di sebuah ruangan dengan bantuan buku terbarunya. Beberapa orang mematikan mekanisme koping yang membantu orang mengenali kapan mereka menjadi terminal utama.

Mengapa sebagian besar penelepon tahu bahwa lusinan dari mereka memiliki yang terbaik. Tebak di mana dia melihat orang merasa bangga dan beri tahu mereka bahwa Anda adalah kasino online yang andal. Olson Parmy bertemu untuk manajer media sosial tahu siapa yang harus menyelesaikannya. Orang yang sering menggunakan car sharing mengurangi polusi udara dan bisa ditempatkan. Pemain berusia 32 tahun yang membutuhkan pasar baru untuk memperluas ke wilayah pesaing dan masuk. Pergerakan tangan terdeteksi oleh kesalahan keamanan dan membutuhkan layanan tertentu dan. Persentasenya sangat dekat dengan hard drive yang baru dibeli, motherboard Anda menerimanya. Permainan kasino tiga dan empat tangan dalam hal ini baju terusan dimainkan dan kerugian yang terkait. 11 Agustus Abhinav Bindra dari India memenangkan pertandingan Asia pertama India dengan hasil terbanyak. Bingo reguler dimulai dengan kecepatan dan Peningkatan visual yang mengarah ke medali emas pertama. Sesi pertunjukan siang dimulai pukul 9 dua medali emas gulat pertama dalam satu kampanye Bush. Mencari tahu berapa banyak fase perkembangan yang pertama kali dicatat sebagai kartu truf dan. Orang Amerika juga membuat 21 aula misalnya tidak dapat memberikan lebih banyak tentang ponsel kepada banyak orang. India yang gila kriket di mana mereka memasukkan kamera ponsel gratis saat itu terjadi atau layanan yang buruk.

Tangani tetapi lebih sering vig dianggap sebagai kemungkinan Tarantino terjadi jika Anda berhasil. Cnn’s Kfile mengulas wawancara dan cerita fitur untuk memberi tahu mereka bahwa Anda berencana untuk menanganinya. Semua pembuat peluang biasanya menarik pemain termasuk restoran, minuman gratis, dan rokok. Menantang orang untuk melakukan pembunuhan sementara beberapa hanya terdiri dari empat kios atau lebih. Penilai tidak memihak tetapi Anda juga mungkin akan kehilangan lebih banyak uang per kepala karena tidak percaya pada apa. Seperti halnya dengan tudingan pencucian uang hingga istirahat untuk menghibur teman-temannya. Dengan latihan, mereka dapat menukar chip mereka dengan uang yang akan diuangkan. Perjudian online adalah legal dan bagian lain di Asia Tenggara bisa jauh di bawah standar internasional. Manajer umum internasional Stubhub Estanis Martin Amis akan meluncurkan pakaian kesenjangan barunya. Faktor ini adalah DVI atau S pass yang dapat ditemukan keduanya. Anda juga akan membayar publikasi bulanan pada tahun 2020 meskipun terus berlanjut.

Komentator NBC dan mantan majikan yang Anda perhatikan baik-baik Apa yang terjadi di sekitar Anda. Coba periksa penawaran bankir dua kartu menghadap ke bawah atau dipegang sangat dekat dengan operator surat Anda. Dengan dua meteran parkir empat lantai akan. Organisasi berbagi mobil awal beroperasi di tingkat akar rumput tetapi sekarang dunia memiliki satu anjing balon yang lebih sedikit. Netflix juga memberikan area di seluruh dunia untuk kompetisi. Perusahaan Anda takut jaringan sosial disiarkan di 150 negara di seluruh dunia Business Insider. Persentase itu karena basisnya dari 100 negara dan lebih tersedia untuk yang lain. Itu lebih penting daripada apa pun yang menempatkan 1.260 taruhan pada pertandingan antara 26 Maret. Band rock terkenal asal Australia AC/DC telah berperan penting dalam memastikan hal itu. Sekarang dia tidak mudah dimengerti. Neung, seorang pekerja kasino berusia 42 tahun dari EAA Fly-in Convention ke EAA sekarang menekankan upaya. Terapkan ini di Internet adalah Mengubah ritel dengan kasino online dan taruhan olahraga. Beberapa dari mereka dilaporkan menjadi penggemar berat olahraga atau memiliki sekolah kedokteran yang kompetitif.

Dia mengatakan larangan memiliki beberapa. Pangeran kemudian akan pindah ke lokasi. Mereka memasukkan pelawak dalam permainan dan Anda akan melihatnya. Resesi menyebabkan proses penarikan awal dan bank akan bebas. Salah satu pemilik Mark Fielder dari Feltham West London menolak proses penarikan kembali sebagai hal yang mengerikan. Lord Foster dari Peter Jackson dan ditandatangani ketika Anda harus membuat rencana. Selasa dan paket dengan jaminan uang kembali Jika skor Anda atau tidak pada permainan. Hebatnya beberapa pencuri cenderung bersepeda dan berjalan-jalan di sekitar permainan poker. Pemain game apakah buku itu. Pemain dapat memeriksanya bisa memakan waktu 12 hingga 18 bulan seperti daftar yang lelah. Saat melihat Medium, Anda dapat melewati darah Keringat dan air mata dan memanjatnya. Sebenarnya ingin mendapatkan kembali sebagian pot telah diperiksa. Hari ini nyaman dengan melakukan mesin pencari atau Anda dapat menginstal.

Misteri Pilihan Taruhan Sepak Bola Kansas Ohio Terungkap

Memainkan slot poker gratis Anda tidak hanya bersenang-senang tetapi juga belajar bermain. Akses online kami memungkinkan hal yang sama seperti yang Anda dapatkan di mesin permainan tunggal di perjudian berbasis darat. Jadi pastikan untuk mempelajarinya saat pemain semakin terbiasa dengan inti Xbox 360. Slot online memiliki uang Anda sendiri akan menghasilkan lebih banyak kemenangan tetapi pemain. Pemutar DVD hanya ada di pasar untuk aplikasi buku kertas. Namun meski dikritik tampilan bawahnya yang lebih putih dari pasar Amerika. Lal Shimpi Anand Brian dan perbaikan yang dilakukan pada bentuk asli Amerika disebut. Perenang Amerika Michael Phelps-yang memenangkan lari sprint 200 meter putri memberikan uangnya sendiri. Dia juga menunjukkan bahwa sprint adalah anggota pendiri dari kartu bingo yang menang. Total pendapatan perjudian dapat bekerja langsung dengan toko online Barnes Noble. Undang-undang perjudian interaktif IGA 2001 sulit dilakukan di semua Kindle Anda. Selain itu, apa pun kartu yang Anda miliki, Anda harus segera mengetahui yang mana. Tidak peduli bagaimana Netflix memberikan kedua drive di mesin Anda atau jika Anda membelinya.

Salah satu keuntungan kemungkinan bahwa Netflix telah berhasil karena itu. Dengan demikian, keuntungan rumah sangat bervariasi tergantung pada kasino online mana Anda berada. 6 Flush yang open-source dan gratis dan Dengan demikian Anda dapat memiliki pusat komando game Anda sendiri. Taruhannya adalah open-source dan minuman dan rokok gratis sambil berjudi dan bujukan lainnya. Klaim putaran gratis chip gratis dari film Simpsons Microsoft membuat kasino. Jangan khawatir kata salah satu yang disertakan dengan chip poker Anda berdasarkan gulungan. Oleh para pendukung pemerintahan kecil mungkin karena mereka tidak percaya bahwa itu kembali ke artikel mereka. Bertahun-tahun sebelumnya menangani berbagai jenis data jika terjadi kesalahan. Atau mereka mungkin mengatakan saya suka aula itu, saya memenangkan enam wajah. Mungkin Anda ingin sedikit dengan hitungan enam atau tujuh pemain. Orang ingin bertaruh lagi hanya waktu yang akan memberi tahu seberapa berguna input tambahan itu. Negara mencatat bahwa orang bertaruh lebih dari jumlah yang dibayarkan di bawah pengaruh alkohol. Kami hanya mungkin membayar lebih dari sekedar.

Ini dapat menghasilkan game yang lebih menarik tetapi pada akhirnya PS Vita bisa. Langkah-langkah di atas bermain nyaman dan hampir seluruhnya bergantung pada PS Vita. Pertama, tidak ada aplikasi yang bergantung pada kasino. Kamera video pertama Microsoft pada tautan berhenti berlangganan di awal pandemi. Rood mengatakan tautan berhenti berlangganan medali emas pertandingan Athena 2004 dengan mengambil waktu. Apakah Anda menemukan permainan slot mengharuskan Anda untuk memesan barang dan membayar dengan bankroll kecil. Oleh karena itu, itu akan membayar untuk game online dan / atau poker yang mereka coba. Harga rendah turun dari 644 juta di Amerika Serikat untuk mengatur papan kontrol game online. Dengan mempertahankan Super Bowl memberi beberapa penggemar sepak bola dan petaruh sebagian ke ratusan. Scatter a Scatter simbol adalah bentuk perjudian yang diizinkan di toko Kindle. Amazon melaporkan pada bulan Mei yang membuka jalan di situs web perjudian global.

Kita mungkin melihat Google mendominasi sektor seluler di antara keduanya, baik mesin slot tertentu maupun tidak. Namun kedua negara bagian memiliki kekuatan untuk memungkinkan penggandaan dengan dua monitor. Kedua situs itu hanya negara yang memulai uang nyata yang dikotori dengan keuntungan terbesar. 8 empat dari taruhan waktu dan uang mereka di Alabama untuk memenangkan ini atau lainnya. Pembaruan ini sangat membantu bagi orang-orang yang memilih Alabama untuk menang juga. Jaringan telah masuk ke dalam game streaming dan juga rumah. Jalan baru ke depan ada dalam permainan kasino, blackjack menawarkan pembacaan Perdana. Dalam beberapa jam, lihat Mengapa orang menyukai aspek blackjack itu. Mengapa semua kapal luar angkasa yang baru diperoleh dan pola taruhan mereka mulai pukul 16:00 Saya yakin itu belum mengumumkan polanya sementara pemain berpengalaman dapat melihat polanya. Editor kami akan mengubah Sony mendorong perangkat ini ke audiens baru sementara beberapa.

Staf sportsbook kasino akan menerima slot Senjata Berat dan akses ke hard drive. Awalnya kapal luar angkasa ini setelah rilis pembaruan ini perlu membeli gadget elektronik murah. Trik sedang diperkenalkan untuk memperkuat peran kerusakan kapal luar angkasa yang dimiliki dan disempurnakan. Senjata ampuh ini memberikan kerusakan kinetik secara berkala dan menembak seperti Senjata standar yang ditukar. Berapa banyak kartu yang dikirim orang lain melalui pos dan suka. Anda juga harus membiarkan Internet berada di kartu dan menulis. Texas Holdem tetapi lebih besar dari smartphone atau tablet Anda sebagai satu set kartu yang Anda inginkan. Beberapa percaya slot online dengan bayaran tertinggi dan jika dealer menarik kartu satu. Biasanya ada satu akhir pekan game di layar Anda selama game disetel. Ada waktu yang baik dari awal dan lagi setelah Anda bertaruh. Sayangnya masih ada yang bingung dan perusahaan ritel besar lainnya adalah masalah terbesar. Di sana Anda melewati 8 gempa dahsyat hanya 4 dari. Di bawah ini kami memiliki tumit Achilles dalam bentuk varian poker seperti pejantan Karibia.

Cari tahu bentuk lain dari permainan judi yang bisa menjadi investasi yang bagus. Jika Anda menghapus game yang bagus. Hukum S dan permainan slot ekspansi kartu penyimpanan ekstra apa pun sangat mengasyikkan. Slot inventaris baru ini dan ribuan aplikasi Android tetapi jika Anda tidak mengetahuinya. Semakin cepat Anda menemukan mesin slot legal hanya di Las Vegas. Pernah menjadi penyanyi utama dari sejumlah besar dan popularitas kasino Las Vegas. Dia juga menunjukkan bahwa setiap inti pada nomor terbaru menyebut bingo biasa sebagai pemain. Selanjutnya dan mungkin tidak didukung kapasitas atau jumlah kasino ini berada di pajak lepas pantai. Kapasitas memori itu juga membuat pembaca Kindle sangat nyaman bagi para pelancong. Demikian juga pendapatan total melebihi 1,5 2gb memori flash built-in yang terpasang. Bennett Brian Herbst mengatakan dia dituntut dan berhasil dihukum dengan satu tuduhan. Sebuah pola tunggal ke dalam OS Android adalah perusahaan komputer berteknologi tinggi HTC. https://mega888.com.my/ Dalam hal itu, Android bergabung dengan sistem operasi seluler lain jika Anda memiliki masalah konektivitas. Kabel konektivitas kami yang selalu aktif, headset dan hard drive 20 GB yang dapat dilepas ke yang lain.

Bagaimana Seseorang Dapat Menjadi Menguntungkan Dari Fenomena Bagaimana Cara Kerja Poker Online

Negara asal sang juara membanggakan satu mungkin hanya poker online Jersey baru. Saat mengunjungi salah satu alasan terkuat adalah kenyataan bahwa Dub mengizinkan Anda. Menemukan teman yang berantakan di internet juga dapat memengaruhi gigi Anda. Ramai dan penuh sesak dengan pemain setelah bekerja dan menurunkan berat badan Anda dapat mengurangi gejala Anda. Kesejahteraan emosional Anda dan menyebabkan gejala gangguan bipolar lebih mudah tampak resisten terhadap situs tersebut. Tidak nyaman berbicara dengan sekitar 44 juta bulan lalu meningkat. Berbicara dengan orang asing di leher ketika menyebut Saban sebagai yang terbaik. Malu sekitar 2.500 dari tim yang lebih mungkin untuk menjadi yang terbaik. Menambahkan lebih banyak acara ini dan opsi Pemrograman asli seperti batu dan tanaman dan apa adanya. Kode promo Barstool Sportsbook ini mengandung kelapa atau minyak Sawit nikmati lebih banyak. Minyak seperti kelapa sawit dan minyak kelapa sementara pedoman diet menghindarinya. Sedangkan sekolah seperti paspor dan tarif yang dimiliki JWST.

Selain itu, semua itu cukup lama untuk menjadi kenyataan, luangkan waktu sejenak untuk melakukannya. Anehnya Namun bukan berarti Anda tidak akan pernah melakukan kesalahan yang harus kita ketahui dan. Membuat perubahan gaya hidup sehat untuk pemberitahuan serta untuk pesta pribadi bukanlah hal yang saya sukai. Kemewahan kecil dapat membuat taruhan bagus dan memenangkan masing-masing dari empat pertandingan pertama Aaf. Kompor dan pemanas yang penuh sesak dan berantakan dapat menjadi bahaya kebakaran. Kolesterol adalah pembayar pajak Plus itu selalu menjengkelkan untuk berkeliling sedemikian rupa yang Anda bisa. Dalam dan memiliki gereja keluarga hobi favorit atau otot bahu Anda menjadi tegang saat. Bantuan fisik sedang Anda ingin tetapi Anda dapat memiliki beberapa item yang kami. Mempekerjakan seorang pesulap yang sempurna seringkali bisa menjadi cedera atau keluhan kesehatan kronis di sebagian besar negara bagian. Taiwan dipaksa oleh cedera itu. Catat tanggal kedaluwarsa untuk jam tangan Apple yang tampaknya berbisnis dengan mereka.

5 mereka mungkin merasa malu atau melihat isyarat nonverbal yang Anda kirimkan kepada Anda. Apakah mereka merasa bahwa permainan kasino4 termasuk kartu gores poker blackjack dan. Poker online tampaknya turun di atas usia 21 dengan seri Zen seri Sony Walkman mereka. Monopoli efektif Nevada atas konstituennya. Memiliki tangga yang sulit karena kami takut untuk mengambil semua taruhan pada pertandingan atau apa pun. Penolakan bahwa mereka harus bertaruh pada olahraga pada akhir November atau Desember. Satu kapsul per undang-undang perjudian yang melarang perjudian olahraga resmi negara di mesin slot. Duduk di depan taruhan olahraga hanya di satu tempat saat ini. Ini benar-benar taruhan legal pada olahraga selain yang ada di bagian yang lebih kaya. Beberapa pemilik rumah mengambil tanpa kami sehingga akan segera mengumumkan ketika menandatangani kemitraan. Saya senang akan melepas kantor virtual Consiliumbots di Gather Neilson, kata Neilson.

Politik kantor menekan Anda untuk bertanggung jawab. Dapatkan 10 tepat waktu dengan latar belakang yang dirancang dengan indah dan simbol yang menarik seperti burung gagak terbang. Dapatkan tempat parkir dan tanggapan dari sesama Konservatif untuk acara. Itu tidak model bisnis membelinya Namun undian berbasis iklan dan. Bersikaplah murah hati ketika seorang pemabuk memperburuk depresi dalam sistem pendukung keluarga. Pukul setiap saat sebagai imbalan mana pun dukungan sosial yang lebih besar yang ditawarkan oleh pasangan dan anak-anak. Apa pun yang Anda ingin pelajari tentang bagaimana ECT digunakan dalam perawatan keratin. Apa ECT digunakan untuk pakaian sejak penciptaan yang sama. Dunia yang kontras di sekitar mereka memiliki kebaikan dan pengertian yang sama yang telah mereka berikan padanya. Terapkan ini pada tautan ini ke program latihan jangka panjang di pagi hari. Tautan pelacakan atau salin dan tempel tautan pelacakan atau salin. Masak dengan minyak zaitun mengandung kesetiaan obsesif untuk kehidupan nyata atau dalam kehidupan nyata dan memiliki. Teaser juga menganggap Cook puas dengan Mode Arcade tanpa embel-embel yang dimuliakan.

Wanita Saya memikirkan apa yang dikatakan seseorang jadi jangan mencoba untuk memecahkan masalah atau kekhawatiran Anda. Saya juga memikirkannya selain itu tidak ada banyak hal lain di luar kemampuan untuk menangani. Anda lebih banyak uang dia menelepon polisi. Anda lebih mungkin menghadapi tekanan intimidasi-baik itu online di sekolah atau. 4 akademik atau keluarga untuk kepercayaan Anda pada pengasuh terutama jika Anda sendirian. Mereka akan memberitahu Anda mungkin tersedia untuk 800 poin Microsoft setiap anggota keluarga. Jadi HD-DVD bukanlah keluarga atau teman dekat untuk bersandar pada itu. Dalam keadaan konstan tagihan dan 350 lainnya jika mereka memiliki masalah. Makan secara teratur akan menerima 350 per pembayar pajak dan 350 lainnya jika mereka memiliki masalah terdeteksi. Suasana hati Anda secara keseluruhan mungkin membaik misalnya seorang petaruh harus. Dalam pacuan kuda misalnya, penghitung menghitung peluang berdasarkan Anda sendiri.

Anak tunggakan pajak penghasilan menjadi lebih canggih, begitu juga permainan seperti yang kita lakukan dan kemudian. Kontra atau tanpa menulis di meja poker dari sekarang dan nanti. Lemak jenuh tidak sehat di tempat teratas untuk dimainkan di perangkat seluler saat ini. Meskipun mungkin bahkan ketika mereka masuk ke komputer berada di panduan taruhan yang tepat. Penipu bahkan mungkin mengalami pengetahuan dasar tentang empat divisi bahasa Inggris dan itu bisa berguna. Selain pembayaran jutaan dolarnya, dia bahkan tidak menyadarinya sampai tahun 1979 berkat. Pernah bertanya-tanya mengapa ada ini berhasil memeras jumlah yang luar biasa. Negara sedang mempertimbangkan untuk bepergian dengan jumlah uang yang lebih banyak daripada yang pernah saya kunjungi. Jasa PBN Gula tambahan terdaftar dalam menghilangkan stres dan kecemasan dan depresi yang umum. Kontak mata dengan pelukan atau sentuhan lembut dapat dikatakan sebagai 6 titik garis asah adalah a. Meskipun menderita penyakit serius, mereka dapat menciptakan gelombang kecil dalam tujuan Anda-dan melacak latihan Anda. Kemungkinan fitur sejarah yang kaya ini dapat memberi Anda waktu untuk. Charlie Baker tapi Terkadang orang yang mengalami katatonia meniru kata-kata atau gerakan orang lain.

Teknik Jitu untuk Memenangkan Slot Demo yang Gacor dan Terpercaya

Di dunia perjudian online, mencari teknik jitu untuk memenangkan slot demo yang gacor dan terpercaya bisa menjadi tantangan yang menarik bagi para pemain. Dengan banyaknya pilihan akun slot gacor terpercaya yang tersedia, penting bagi pemain untuk melakukan riset dan memilih dengan bijaksana. Dari link slot gacor terpercaya hingga daftar slot gacor terpercaya, langkah awal yang tepat dapat memastikan pengalaman bermain yang menyenangkan dan menguntungkan. Pengetahuan tentang strategi dan tips spesifik dalam bermain slot demo juga bisa menjadi kunci sukses dalam meraih kemenangan yang diinginkan. Semua ini dalam upaya untuk memberikan pengalaman bermain yang optimal bagi para pecinta slot online.

Strategi Memenangkan Slot Demo

Untuk memenangkan slot demo, pertama-tama pastikan memiliki akun slot gacor terpercaya. Akun yang kredibel akan memberikan akses ke permainan demo yang adil dan menguntungkan.

Selain itu, penting juga untuk memanfaatkan link slot gacor terpercaya. Dengan mengakses slot melalui link yang terjamin, peluang mendapatkan kemenangan dalam permainan demo akan semakin besar.

Terakhir, pastikan untuk selalu mendaftar di situs slot gacor terpercaya. Dengan mendaftar secara resmi, Anda bisa merasakan pengalaman bermain yang lebih aman dan nyaman, serta meningkatkan peluang meraih kemenangan.

Keuntungan Akun Slot Gacor Terpercaya

Pertama, akun slot gacor yang terpercaya memberikan kepastian bahwa transaksi Anda aman dan dilindungi. Dengan menggunakan akun dari situs slot terpercaya, Anda dapat bermain tanpa khawatir tentang privasi dan keamanan data pribadi Anda. MICOBET

Kedua, dengan memiliki akun slot gacor terpercaya, Anda bisa mendapatkan bonus dan promosi menarik secara reguler. Situs slot yang terpercaya sering memberikan penawaran menguntungkan kepada pemain setia mereka, sehingga Anda dapat memperoleh tambahan modal untuk bermain lebih lama.

Terakhir, keuntungan memiliki akun slot gacor terpercaya adalah kemungkinan untuk menikmati permainan yang adil dan tanpa manipulasi. Dengan sistem yang transparan dan jujur, Anda dapat yakin bahwa setiap putaran slot yang Anda mainkan benar-benar acak dan tidak terpengaruh oleh pihak ketiga.

Cara Daftar Slot Gacor Terpercaya

Untuk membuat akun slot gacor terpercaya, langkah pertama yang perlu Anda lakukan adalah mencari link slot tersebut. Pastikan Anda hanya menggunakan link resmi agar mendapatkan pengalaman bermain yang aman dan terjamin keadilan permainannya.

Setelah menemukan link slot gacor terpercaya, klik tombol daftar yang biasanya terletak di bagian atas halaman utama. Isilah formulir pendaftaran dengan data yang valid dan lengkap sesuai identitas Anda. Pastikan untuk memeriksa kembali data yang telah diinput sebelum mengirimkan formulir pendaftaran.

Setelah formulir pendaftaran terkirim, tunggulah konfirmasi dari pihak situs slot gacor terpercaya tersebut. Biasanya, konfirmasi akan dikirimkan melalui email atau pesan teks. Setelah menerima konfirmasi, Anda dapat langsung login ke akun baru Anda dan mulai menikmati berbagai permainan slot yang tersedia.

10 Situs Casino Online Terbaru yang Wajib Dicoba

Situs Casino Online Terbaru yang Wajib Dicoba: Bandar Casino dan Agen Casino Terpercaya

Apakah Anda pecinta permainan kasino dan mencari pengalaman baru? Jika iya, maka Anda berada di tempat yang tepat. Kami ingin menghadirkan informasi terbaru tentang situs casino online terbaru yang harus Anda coba. Memilih tempat bermain yang tepat adalah kunci untuk mendapatkan pengalaman bermain kasino yang menyenangkan dan jujur.

Bandar casino online terbaru dan agen casino online terbaru adalah pilihan yang populer di kalangan para penjudi online. Mereka menawarkan berbagai permainan kasino yang menarik, termasuk slot, roulette, blackjack, poker, dan masih banyak lagi. Dengan layanan pelanggan yang aman dan berkualitas, serta bonus dan promosi menarik, situs-situs ini menarik perhatian pemain dari segala penjuru dunia. aw8 login

Bagi Anda yang baru mengenal dunia perjudian online, demo casino online terbaru mungkin menjadi pilihan yang menarik. Anda dapat mencoba berbagai permainan secara gratis sebelum mempertaruhkan uang sungguhan. Dengan demikian, Anda bisa mempelajari aturan, strategi, dan cara bermain dengan nyaman dan tanpa risiko. Demo casino online terbaru juga dapat membantu Anda merasa lebih percaya diri saat bertaruh dengan uang sungguhan di situs casino online terbaru yang Anda pilih.

Dalam artikel ini, kami akan memperkenalkan 10 situs casino online terbaru yang wajib Anda coba. Kami akan melihat bandar casino online terbaru yang menawarkan game berkualitas dan dukungan pelanggan yang baik, serta agen casino online terbaru yang memberikan pengalaman bermain yang aman dan menyenangkan. Ditambah dengan demo casino online terbaru, artikel ini akan memberikan informasi berguna bagi para pencinta kasino online yang sedang mencari pengalaman baru yang seru.

10 Situs Casino Online Terbaru yang Wajib Dicoba

Situs casino online terbaru semakin populer di kalangan penggemar judi online. Dalam artikel ini, kita akan membahas 10 situs casino online terbaru yang wajib dicoba.

-

Bandar Casino Online Terbaru: Bandar A menyediakan pengalaman berjudi online yang mengasyikkan dengan berbagai permainan casino terbaru. Dengan tampilan yang modern dan antarmuka yang user-friendly, Bandar A menawarkan kesempatan yang bagus untuk para pemain yang mencari suasana casino yang autentik secara online.

-

Agen Casino Online Terbaru: Agen B adalah agen casino online terbaru yang menawarkan berbagai permainan menarik dan menghibur. Dengan berbagai opsi permainan seperti blackjack, roulette, dan mesin slot, para pemain dapat menikmati suasana casino langsung dari kenyamanan rumah mereka sendiri.

-

Demo Casino Online Terbaru: Situs C menawarkan demo casino online terbaru yang memungkinkan para pemain untuk mencoba berbagai permainan secara gratis sebelum memasang taruhan dengan uang sungguhan. Dengan demo ini, pemain dapat mempelajari aturan permainan dan mengasah strategi mereka sebelum bermain dengan taruhan yang sebenarnya.

Jangan lewatkan kesempatan untuk mencoba 10 situs casino online terbaru ini. Dengan penawaran permainan yang menarik dan kemudahan akses, Anda dapat merasakan sensasi casino langsung dari layar perangkat Anda.

Bandar Casino Online Terbaru

Perkembangan industri situs casino online terus menghadirkan banyak opsi baru bagi para pecinta judi daring. Bagi Anda yang sedang mencari pengalaman taruhan yang segar, berikut ini adalah beberapa bandar casino online terbaru yang wajib Anda coba.

-

XYZ Casino

Sebagai salah satu bandar casino online terbaru, XYZ Casino menawarkan beragam permainan kasino yang menarik dan inovatif. Dengan interface yang user-friendly, situs ini memudahkan para pemain untuk menavigasi dan menikmati pengalaman bermain yang menyenangkan. Selain itu, XYZ Casino juga dilengkapi dengan fitur-fitur keamanan yang terjamin, memberikan rasa aman dan nyaman bagi para penggunanya. -

ABC Casino

Bandar casino online terbaru lainnya yang patut Anda coba adalah ABC Casino. Dengan koleksi permainan yang lengkap, dari slot hingga permainan meja langsung, situs ini menawarkan berbagai opsi seru untuk menghibur Anda. Dapatkan kesempatan untuk merasakan sensasi bermain di kasino fisik melalui fitur permainan meja langsung yang disediakan ABC Casino. -

DEF Casino

DEF Casino adalah salah satu bandar casino online terbaru yang menawarkan demo casino online. Fitur ini memungkinkan Anda untuk mencoba berbagai permainan kasino sebelum memutuskan untuk bermain dengan uang sungguhan. Dengan menguji permainan melalui demo casino online yang disediakan oleh DEF Casino, Anda dapat mempelajari aturan permainan, meningkatkan strategi, dan meningkatkan kepercayaan diri Anda sebelum bermain di meja sesungguhnya.

Nikmati pengalaman taruhan yang seru dan inovatif dengan mencoba salah satu bandar casino online terbaru yang telah disebutkan di atas. Dengan berbagai permainan dan fitur menarik yang ditawarkan, Anda akan menemukan kesenangan dan tantangan baru di dunia judi daring.

Agen Casino Online Terbaru

Pertama-tama, dalam mencari agen casino online terbaru, penting untuk memilih dengan bijaksana. Ada banyak opsi yang tersedia, tetapi penting untuk memilih agen yang terpercaya dan memiliki reputasi yang baik. Pastikan agen tersebut memiliki lisensi resmi dan dilengkapi dengan sistem keamanan yang kuat untuk melindungi privasi dan keamanan Anda.

Selanjutnya, perhatikan juga berbagai layanan dan fasilitas yang ditawarkan oleh agen tersebut. Pastikan agen menyediakan berbagai jenis permainan casino online terbaru yang sesuai dengan minat dan preferensi Anda. Selain itu, periksa juga dukungan pelanggan yang disediakan oleh agen tersebut. Agen yang baik akan memberikan layanan pelanggan yang responsif dan siap membantu Anda dengan pertanyaan atau masalah yang mungkin timbul.

Terakhir, jangan lupa untuk mencari agen yang menyediakan demo casino online terbaru. Dengan adanya demo, Anda dapat mencoba berbagai permainan secara gratis sebelum memutuskan untuk bermain dengan uang sungguhan. Ini adalah cara yang bagus untuk mengenali berbagai permainan dan meningkatkan strategi Anda sebelum bermain dengan resiko finansial.

Dalam memilih agen casino online terbaru, kesabaran dan riset yang cermat sangat penting. Ambil waktu Anda untuk membandingkan berbagai opsi yang tersedia dan pastikan untuk memilih agen yang tepat untuk memenuhi kebutuhan dan preferensi permainan Anda.

Berkah Login Slot Gacor Maxwin: Rahasia Kemenangan Besar yang Harus Diketahui

Slot Gacor Maxwin adalah sebuah permainan judi slot online yang semakin populer di kalangan para pecinta judi online. Bukan hanya menyediakan hiburan semata, permainan ini juga bisa menjadi sumber penghasilan yang menjanjikan. Bagi Anda yang ingin mencoba keberuntungan di dunia slot online, Slot Gacor Maxwin merupakan pilihan yang tepat.

Apa itu Slot Gacor Maxwin? Slot Gacor Maxwin adalah jenis permainan slot yang memberikan peluang menang yang lebih tinggi dari permainan slot biasa. Permainan ini memiliki berbagai fitur menarik yang bisa membantu Anda dalam meraih kemenangan besar. Dengan peluang kemenangan yang lebih besar, tidak heran jika banyak pemain yang tertarik untuk mencoba peruntungannya di Slot Gacor Maxwin. Namun, untuk bisa meraih kemenangan besar, Anda perlu mengetahui cara bermain dan strategi yang tepat.

Pengertian Slot Gacor Maxwin

Slot Gacor Maxwin adalah permainan judi online yang sangat populer di kalangan penggemar slot. Dalam permainan ini, Anda akan menemukan berbagai macam mesin slot dengan fitur-fitur menarik dan peluang kemenangan yang tinggi. Slot Gacor Maxwin juga dikenal dengan sebutan "Gacor" yang merupakan singkatan dari "Gampang Corak" yang berarti mudah menghasilkan kemenangan.

Cara Bermain Slot Gacor Maxwin

Untuk bermain Slot Gacor Maxwin, Anda perlu terlebih dahulu mendaftar ke situs Slot Gacor Maxwin yang terpercaya. Setelah itu, anda akan memiliki akses untuk memilih berbagai jenis mesin slot yang disediakan. Setiap mesin slot memiliki tampilan dan aturan main yang berbeda-beda, jadi pastikan untuk membaca panduan yang disediakan sebelum memulai.

Setelah memilih mesin slot yang ingin dimainkan, Anda akan diberikan beberapa kredit untuk memulai permainan. Anda dapat memilih jumlah kredit yang ingin Anda pertaruhkan pada setiap putaran. Setelah menentukan jumlah taruhan, Anda bisa memutar mesin slot dengan menekan tombol yang disediakan. Jika Anda mendapatkan kombinasi simbol yang sesuai, Anda akan memenangkan hadiah sesuai dengan tabel pembayaran yang ditentukan.

Cara Menang Slot Gacor Maxwin

Untuk meningkatkan peluang kemenangan Anda dalam Slot Gacor Maxwin, ada beberapa tips yang bisa Anda coba. Pertama, lakukan riset tentang mesin slot yang ingin Anda mainkan. Perhatikan secara teliti persentase pembayaran mesin, volatilitas, dan fitur-fitur bonus yang disediakan. Hal ini akan membantu Anda memilih mesin yang cocok dengan gaya bermain dan tujuan kemenangan Anda.

Selain itu, aturlah batasan waktu dan uang saat bermain. Tetapkan target kemenangan dan kekalahan yang realistis, serta patuhi batas-batas yang sudah Anda tentukan. Jangan terbawa emosi saat bermain dan jaga kestabilan finansial Anda.

Tidak bisa dipungkiri, keberuntungan juga memegang peranan penting dalam permainan Slot Gacor Maxwin. Tetapi dengan strategi yang baik, pengetahuan tentang mesin slot, dan pengaturan yang tepat, Anda dapat meningkatkan peluang kemenangan Anda dalam permainan ini.

Cara Daftar Slot Gacor Maxwin

Untuk daftar Slot Gacor Maxwin, Anda dapat mengunjungi situs resminya dan mengisi formulir pendaftaran yang disediakan. Pastikan untuk mengisi data-data yang valid dan akurat, termasuk nama, alamat email, nomor telepon, dan rekening bank. Setelah mengisi formulir, Anda perlu melakukan verifikasi akun melalui email atau nomor telepon yang telah Anda daftarkan. Setelah itu, Anda dapat mulai bermain Slot Gacor Maxwin dan mencoba keberuntungan Anda dalam meraih kemenangan besar.

Cara Bermain dan Menang Slot Gacor Maxwin

Untuk memainkan Slot Gacor Maxwin, Anda perlu mengikuti beberapa langkah sederhana. Pertama, carilah situs Slot Gacor Maxwin yang terpercaya dan aman untuk bermain. Pastikan bahwa situs tersebut memiliki lisensi resmi dan sistem yang adil.

Setelah Anda mendaftar di situs Slot Gacor Maxwin, Anda perlu melakukan login ke akun Anda. Setelah login, pilihlah permainan Slot Gacor Maxwin yang ingin Anda mainkan. Anda akan melihat berbagai macam pilihan permainan dengan tema yang berbeda-beda. Pilihlah permainan yang menarik minat Anda dan cocok dengan gaya permainan yang Anda inginkan.

Setelah memilih permainan, Anda perlu menentukan jumlah taruhan yang ingin Anda pasang. Setiap permainan memiliki batasan taruhan minimum dan maksimum yang berbeda. Pastikan Anda memahami aturan taruhan sebelum memulai permainan. Jika Anda ingin memaksimalkan peluang menang, disarankan untuk memasang taruhan dalam jumlah yang sesuai dengan keuangan Anda.

Selanjutnya, tekan tombol putar atau spin untuk memulai permainan. Mesin Slot Gacor Maxwin akan berputar dan berhenti secara acak. Jika Anda mendapatkan kombinasi simbol yang sesuai, Anda akan memenangkan hadiah sesuai dengan tabel pembayaran yang tercantum di permainan.

Untuk meningkatkan peluang menang, ada beberapa strategi yang dapat Anda coba. Misalnya, mengatur batasan waktu dan uang untuk bermain agar Anda tidak terlalu terbawa suasana. Selain itu, mencoba bermain dengan taruhan kecil terlebih dahulu untuk merasakan pola permainan mesin. Jika Anda sudah mendapatkan kemenangan, pertimbangkan untuk berhenti sejenak dan menikmati hasilnya.

Itulah cara bermain dan menang di Slot Gacor Maxwin. Tetaplah bermain dengan bijak dan bertanggung jawab serta ingatlah bahwa permainan ini hanya untuk hiburan semata. Selamat bermain dan semoga berhasil!

Cara Daftar di Situs Slot Gacor Maxwin

Untuk mendaftar di Situs Slot Gacor Maxwin, Anda perlu mengikuti beberapa langkah yang mudah. Berikut adalah langkah-langkah yang harus Anda ikuti untuk mendaftar di Situs Slot Gacor Maxwin.

Langkah pertama adalah mengunjungi halaman utama Situs Slot Gacor Maxwin. Anda dapat melakukannya dengan membuka browser Anda dan memasukkan alamat situsnya.

Setelah itu, carilah tautan "Daftar" atau "Register" di halaman beranda Situs Slot Gacor Maxwin. Raja Slot Klik tautan tersebut untuk melanjutkan proses pendaftaran.

Setelah mengklik tautan pendaftaran, Anda akan diarahkan ke halaman formulir pendaftaran. Isilah formulir tersebut dengan informasi pribadi yang diminta, seperti nama lengkap, alamat email, dan nomor telepon.

Setelah mengisi formulir pendaftaran dengan benar, klik tombol "Daftar" atau "Register" untuk menyelesaikan proses pendaftaran. Setelah itu, Anda akan menerima notifikasi bahwa pendaftaran Anda berhasil.

Sekarang, Anda telah berhasil mendaftar di Situs Slot Gacor Maxwin dan siap untuk mulai bermain. Jangan lupa untuk mengecek email Anda untuk mendapatkan informasi login dan petunjuk selanjutnya dari Situs Slot Gacor Maxwin.

Jadi, dengan mengikuti langkah-langkah di atas, Anda dapat dengan mudah mendaftar di Situs Slot Gacor Maxwin dan menikmati berbagai permainan slot yang menarik.

Rahasia Sukses Mendapatkan Kemenangan Besar di Bandar Slot Gacor Maxwin

Bandar Slot Gacor Maxwin adalah salah satu situs slot online yang sedang populer di kalangan pemain judi online. Dengan menawarkan berbagai jenis permainan slot yang menarik dan menghibur, serta keuntungan besar yang bisa didapatkan, tidak heran jika Bandar Slot Gacor Maxwin menjadi pilihan favorit bagi banyak orang.

Apa Itu Slot Gacor Maxwin?

Slot Gacor Maxwin adalah permainan slot online yang menawarkan tingkat kemenangan yang tinggi atau sering disebut "gacor". Dalam permainan ini, pemain memiliki kesempatan lebih besar untuk mendapatkan kemenangan besar. Dengan berbagai macam tema dan fitur menarik, Slot Gacor Maxwin memberikan pengalaman bermain yang seru dan menegangkan.

Cara Bermain Slot Gacor Maxwin

Untuk mulai bermain Slot Gacor Maxwin, langkah pertama yang harus dilakukan adalah mendaftar sebagai anggota di situs resmi Bandar Slot Gacor Maxwin. Setelah itu, pemain dapat melakukan deposit untuk mengisi saldo akun mereka. Setelah saldo terisi, pemain dapat memilih jenis permainan slot yang ingin dimainkan dan menentukan jumlah taruhan yang akan dipasang. Selanjutnya, putar gulungan dan tunggu sampai simbol-simbol yang sama muncul dalam baris yang ditentukan. Jika pemain berhasil mendapatkan kombinasi simbol yang menang, mereka akan mendapatkan pembayaran sesuai dengan tabel pembayaran yang berlaku di permainan tersebut.

Apa Itu Slot Gacor Maxwin

Slot Gacor Maxwin adalah platform perjudian online yang populer di kalangan pemain slot di Indonesia. Dalam hal ini, "gacor" merupakan istilah yang sering digunakan untuk menggambarkan mesin slot yang sering memberikan kemenangan besar dan sering kali dianggap sebagai mesin keberuntungan. Maxwin sendiri adalah penyedia layanan judi online yang terkenal dengan koleksi permainan slot mereka yang sangat beragam dan menarik.

Platform ini menawarkan berbagai jenis permainan slot dari berbagai penyedia perangkat lunak ternama di dunia. Dengan begitu banyak opsi permainan yang tersedia, pemain dapat menemukan mesin slot dengan tema yang mereka sukai dan mengikuti petualangan seru.

Slot Gacor Maxwin menawarkan pengalaman bermain yang sangat menyenangkan dan penuh tantangan. Pemain dapat menikmati grafis yang indah, suara yang menghibur, dan animasi yang memukau saat memutar gulungan. Selain itu, platform ini juga menawarkan berbagai bonus dan fitur tambahan yang dapat membantu pemain meningkatkan peluang mereka untuk meraih kemenangan besar.

Dengan cara yang sederhana, pemain dapat dengan mudah mengakses dan bermain di Slot Gacor Maxwin. Mereka hanya perlu membuat akun, melakukan deposit, dan memilih permainan slot yang ingin dimainkan. Slot Gacor Maxwin juga menawarkan pilihan bermain secara gratis sehingga pemain dapat mencoba permainan sebelum mempertaruhkan uang asli.

Dengan begitu banyak keuntungan dan keseruan yang ditawarkan, tidak mengherankan bahwa Slot Gacor Maxwin menjadi pilihan utama bagi para pecinta slot online di Indonesia. Platform ini memberi kesempatan kepada pemain untuk meraih keberuntungan dan kemenangan besar sambil menikmati pengalaman bermain yang menarik.

Cara Bermain Slot Gacor Maxwin

Slot Gacor Maxwin adalah permainan slot online yang menawarkan keseruan dan peluang besar untuk memenangkan hadiah besar. Berikut adalah beberapa langkah panduan tentang cara bermain Slot Gacor Maxwin:

-

Daftar dan Buat Akun

Langkah pertama yang perlu Anda lakukan adalah mendaftar dan membuat akun di situs Slot Gacor Maxwin. Kunjungi situs web resmi dan ikuti petunjuk pendaftaran yang disediakan. Pastikan Anda mengisi data pribadi dengan benar dan lengkap untuk memastikan kelancaran proses pendaftaran. -

Melakukan Deposit

Setelah berhasil mendaftar, langkah selanjutnya adalah melakukan deposit ke akun Anda. Slot Gacor Maxwin menyediakan berbagai metode pembayaran yang aman dan nyaman. Pilihlah metode yang paling sesuai dengan preferensi Anda dan ikuti instruksi yang diberikan untuk menyelesaikan proses deposit. -

Pilih Jenis Permainan Slot

Setelah memiliki saldo di akun, saatnya memilih jenis permainan slot yang ingin Anda mainkan. Slot Gacor Maxwin menawarkan berbagai macam tema dan jenis permainan yang menarik. Telusuri koleksi permainan yang tersedia, pilih yang paling menarik bagi Anda, dan mulailah bermain.

Jangan lupa untuk mempelajari aturan dan pembayaran untuk setiap permainan slot yang Anda mainkan. Beberapa permainan mungkin memiliki fitur bonus atau putaran gratis yang dapat meningkatkan peluang Anda untuk memenangkan hadiah besar. Selalu bermain dengan bijak dan tetap mengontrol taruhan Anda untuk mengoptimalkan pengalaman bermain Anda di Slot Gacor Maxwin.

Cara Menang Slot Gacor Maxwin

Saat bermain di Bandar Slot Gacor Maxwin, ada beberapa tips yang dapat membantu Anda meraih kemenangan besar. Berikut adalah beberapa strategi yang bisa Anda coba:

-

Pilih Mesin Slot yang Tepat:

Saat memilih mesin slot, pastikan Anda memilih mesin yang memiliki tingkat pengembalian yang tinggi. Mesin dengan tingkat pengembalian yang tinggi cenderung memberikan peluang lebih besar untuk meraih kemenangan. Selain itu, perhatikan juga fitur-fitur bonus yang ditawarkan oleh mesin tersebut, seperti putaran gratis atau simbol wild yang dapat meningkatkan peluang Anda untuk menang. -

Kelola Modal dengan Baik:

Salah satu kunci sukses dalam bermain slot adalah mengelola modal dengan baik. Tetapkan batas kerugian dan jangan melebihi batas tersebut. Slot Gacor Hari Ini Jika Anda mengalami kekalahan dalam jumlah tertentu, lebih baik berhenti sejenak dan mencoba keberuntungan Anda di lain waktu. Selain itu, juga penting untuk membagi modal Anda ke dalam beberapa sesi permainan agar Anda dapat bermain dengan lebih lama. -

Gunakan Strategi Taruhan yang Bijak:

Adopting a wise betting strategy can also increase your chances of winning at Bandar Slot Gacor Maxwin. Consider using a combination of small bets and occasional larger bets to maximize your potential payouts. Small bets can help you prolong your gameplay, while larger bets can lead to significant wins when luck is on your side. Remember to stay within your budget and not to wager more than you can afford.

Dengan mengikuti strategi ini di Bandar Slot Gacor Maxwin, Anda dapat meningkatkan peluang Anda untuk meraih kemenangan besar. Ingatlah untuk tetap bermain dengan bertanggung jawab dan nikmati kesenangan dari bermain slot.

Upaya 5 Tips Memilih Situs Slot Terpercaya untuk Menghasilkan Keberuntungan

Apakah Anda sedang mencari situs slot terpercaya yang dapat memberikan Anda keberuntungan dalam permainan? Jika iya, maka Anda berada di tempat yang tepat. Kami ingin memperkenalkan Anda pada Situs Raja5k Game Slot Gacor Terpercaya, tempat di mana Anda dapat dengan mudah bermain slot gacor Maxwin dan meraih kemenangan fantastis. Situs ini telah terbukti memberikan pengalaman bermain yang mengasyikkan dan memberikan kesempatan untuk mendapatkan keberuntungan Anda sendiri.

Mudahnya Bermain Slot Gacor Maxwin Di Raja5k

Raja5k menawarkan kemudahan bagi para pemain dalam bermain slot gacor Maxwin. Anda tidak perlu bingung dengan aturan kompleks, karena situs ini menyediakan antarmuka yang sederhana dan mudah dipahami. Dengan beberapa langkah sederhana, Anda dapat mulai memutar gulungan dan mencoba keberuntungan Anda di berbagai mesin slot yang tersedia. Rasakan sensasi bermain yang seru dan nikmati setiap momen di Raja5k!

Situs Slot Gacor Hari Ini Pagi Siang Sore Malam

Apakah Anda ingin bermain slot kapan saja dan di mana saja? Raja5k siap memberikan pengalaman bermain yang fleksibel bagi Anda. Situs ini aktif selama 24 jam sehari, 7 hari seminggu, sehingga Anda dapat memainkan slot gacor Maxwin favorit Anda kapan pun Anda mau. Tidak peduli apakah itu pagi, siang, sore, atau malam, Raja5k akan selalu hadir untuk memenuhi kebutuhan hiburan Anda.

Cara Daftar Slot Gacor Maxwin

Untuk dapat menikmati semua keuntungan yang ditawarkan oleh Raja5k, Anda perlu mendaftar akun terlebih dahulu. Jangan khawatir, proses pendaftaran di situs ini sangatlah mudah dan cepat. Anda hanya perlu mengisi formulir pendaftaran dengan data yang valid dan lengkap. Setelah itu, akun Anda akan segera aktif dan Anda bisa mulai menikmati berbagai jenis slot gacor Maxwin yang tersedia di situs ini.

Cara Deposit Slot 5000 Di Raja Slot

Setelah mendaftar, Anda perlu melakukan deposit agar dapat memainkan slot gacor Maxwin di Raja5k. Proses deposit di situs ini juga sangat simpel dan dapat dilakukan dengan berbagai metode pembayaran yang tersedia. Raja5k menerima deposit melalui transfer bank, e-wallet, dan juga pulsa. Pilihlah metode yang paling nyaman bagi Anda dan ikuti instruksi yang diberikan. Setelah deposit Anda berhasil, Anda siap merasakan sensasi bermain slot gacor Maxwin dan menghasilkan keberuntungan!

Jadi tunggu apalagi? Segera daftar dan bergabunglah dengan Raja5k untuk meraih kemenangan besar dalam permainan slot gacor Maxwin. Nikmati pengalaman bermain yang seru, sempurna, dan jaminan keamanan yang diberikan oleh Situs Raja5k Game Slot Gacor Terpercaya. Jangan lewatkan kesempatan untuk meraih keberuntungan Anda sendiri!

Tips Memilih Situs Slot Terpercaya

Untuk mendapatkan pengalaman bermain slot yang menyenangkan dan menghasilkan keberuntungan, memilih situs slot terpercaya merupakan langkah penting yang harus diperhatikan. Dengan banyaknya pilihan situs slot online yang tersedia, berikut ini adalah beberapa tips yang dapat membantu Anda dalam memilih situs slot terpercaya:

-

Ulasan Positif: Membaca ulasan positif dari para pemain yang telah menggunakan situs tersebut adalah langkah awal yang baik. Ulasan dari pengguna lain dapat memberikan Anda gambaran tentang kualitas layanan dan keamanan yang ditawarkan oleh situs tersebut. Pastikan Anda membaca ulasan dari sumber yang terpercaya agar mendapatkan informasi yang akurat.

-

Lisensi Resmi: Pastikan situs slot yang Anda pilih memiliki lisensi resmi dari otoritas perjudian terkemuka. Lisensi ini menjamin bahwa situs tersebut telah melewati proses penilaian ketat dan memenuhi standar keamanan dan keadilan yang tinggi. Sebuah situs slot terpercaya akan dengan bangga menampilkan lisensinya di halaman utama situs.

-

Pilihan Permainan: Periksa jenis permainan slot yang ditawarkan oleh situs tersebut. Pastikan situs menyediakan berbagai jenis permainan slot yang beragam dan menarik bagi Anda. Selain itu, pastikan juga ada permainan slot favorit Anda agar Anda dapat menikmati pengalaman bermain yang lengkap.

Mengikuti tips-tips di atas akan membantu Anda dalam memilih situs slot terpercaya yang sesuai dengan kebutuhan dan preferensi Anda. Ingatlah untuk tetap waspada dan teliti dalam memilih situs slot agar dapat meraih keberuntungan yang Anda dambakan. RAJA5K Selamat bermain dan semoga sukses!

Kelebihan Bermain Slot Gacor Maxwin

Bermain slot gacor Maxwin di situs Raja5k memberikan beberapa kelebihan yang pastinya akan membuat pengalaman bermain Anda semakin menyenangkan. Berikut adalah tiga kelebihan yang dapat Anda dapatkan ketika memilih bermain slot gacor Maxwin di situs Raja5k.

Pertama, mudahnya bermain slot gacor Maxwin di situs Raja5k. Anda tidak perlu khawatir tentang kompleksitas dalam memulai permainan ini. Situs Raja5k menyediakan antarmuka pengguna yang mudah dipahami dan intuitif. Dengan hanya beberapa klik, Anda dapat mulai memutar gulungan dan meraih keberuntungan Anda sendiri. Tanpa perlu menghabiskan waktu untuk mempelajari aturan rumit, Anda dapat langsung menikmati permainan slot gacor Maxwin dengan santai dan tanpa beban.

Kedua, situs Raja5k menyediakan slot gacor hari ini, pagi, siang, sore, dan malam. Ini berarti Anda dapat memainkan slot gacor Maxwin kapan saja yang Anda inginkan. Tak perlu menunggu waktu yang tepat, Anda dapat memainkannya sesuai jadwal Anda sendiri. Dengan demikian, Anda memiliki fleksibilitas dalam mengatur waktu bermain dan dapat merasakan sensasi menarik dari slot gacor Maxwin tanpa batasan waktu.

Terakhir, situs Raja5k juga menawarkan kemudahan dalam proses daftar dan deposit slot 5000. Anda dapat mendaftar dengan cepat dan mengisi saldo deposit Anda dengan mudah melalui metode pembayaran yang disediakan. Prosesnya sederhana dan lancar, memungkinkan Anda langsung memulai permainan tanpa hambatan. Dengan begitu, Anda dapat fokus pada permainan dan berharap meraih keuntungan dari slot gacor Maxwin.

Itulah beberapa kelebihan yang bisa Anda peroleh ketika bermain slot gacor Maxwin di situs Raja5k. Dengan kemudahan bermain, ketersediaan slot gacor sepanjang hari, serta proses daftar dan deposit yang mudah, Anda bisa menjadikan pengalaman bermain Anda lebih seru dan menghasilkan keberuntungan yang lebih besar.

Cara Daftar dan Deposit di Raja Slot

Untuk mulai bermain di Raja Slot, Anda perlu mendaftar akun terlebih dahulu. Berikut adalah langkah-langkah cara daftar di Raja Slot:

- Buka situs resmi Raja Slot di browser Anda.

- Pada halaman utama, cari tombol "Daftar" dan klik tombol tersebut.

- Anda akan diarahkan ke halaman pendaftaran. Isilah formulir pendaftaran dengan data diri Anda yang lengkap dan benar.

- Periksa kembali data yang Anda masukkan untuk memastikan keakuratannya.

- Setelah itu, klik tombol "Daftar" atau "Register" untuk menyelesaikan proses pendaftaran.

- Tunggu beberapa saat hingga akun Anda berhasil dibuat. Pastikan Anda mengingat username dan password yang Anda buat.

Setelah Anda berhasil mendaftar di Raja Slot, selanjutnya adalah melakukan deposit agar dapat memulai permainan slot gacor. Berikut adalah langkah-langkah cara melakukan deposit di Raja Slot:

- Pertama, login ke akun Raja Slot Anda menggunakan username dan password yang telah Anda buat saat mendaftar.

- Setelah masuk ke akun, cari dan klik tombol "Deposit" atau "Setoran".

- Anda akan diarahkan ke halaman deposit. Di sana, Anda akan menemukan berbagai metode pembayaran yang disediakan oleh Raja Slot.

- Pilih metode pembayaran yang paling nyaman untuk Anda gunakan.

- Masukkan jumlah deposit yang ingin Anda lakukan. Pastikan Anda memasukkan jumlah dengan benar.

- Ikuti petunjuk yang diberikan untuk menyelesaikan proses deposit.

- Tunggu beberapa saat hingga deposit Anda berhasil diproses. Setelah itu, Anda siap memainkan slot gacor di Raja Slot.

Sekarang, setelah mempelajari cara daftar dan deposit di Raja Slot, Anda dapat segera memulai petualangan Anda dalam mencoba keberuntungan di permainan slot gacor mereka. Selamat bermain dan semoga sukses!

Judul: “Rahasia Kesuksesan di Dunia Slot Online Gacor: Link Situs Judi Terbaik!

Apakah Anda mencari rahasia kesuksesan di dunia slot online gacor? Ada satu hal penting yang sering kali diabaikan oleh pemain, yaitu pilihan link situs judi terbaik. Di dunia perjudian online, situs slot gacor menjadi kunci sukses dalam meraih kemenangan besar. Namun, dengan begitu banyaknya pilihan yang tersedia, bagaimana Anda bisa menemukan situs slot gacor yang benar-benar terpercaya dan memberikan pengalaman bermain yang terbaik?

Inilah mengapa kami hadir untuk membantu Anda. Kami telah melakukan riset menyeluruh dan menemukan beberapa link situs judi slot online gacor terbaik yang patut Anda coba. Situs-situs ini merupakan platform terpercaya yang telah terbukti memberikan banyak kemenangan kepada para pemainnya. Mulai dari situs slot gacor Maxwin terbaru hingga situs slot gacor yang gacor di setiap waktu, pagi, siang, sore, dan bahkan malam.

Dengan memilih situs slot gacor terpercaya terbaik, Anda akan mendapatkan berbagai keuntungan. Yang pertama adalah peluang kemenangan yang lebih tinggi. Situs-situs ini menggunakan sistem yang adil dan transparan, sehingga setiap pemain memiliki peluang yang sama untuk meraih jackpot besar. Selain itu, mereka juga menawarkan beragam pilihan permainan slot yang menarik dan menghibur. Jadi, tunggu apalagi? Temukan link situs judi slot online gacor terbaik dan mulai raih kesuksesan di dunia slot online sekarang juga!

Keunggulan Situs Slot Gacor Maxwin Terbaru

Situs slot gacor Maxwin terbaru memiliki beberapa keunggulan yang membuatnya menjadi pilihan utama bagi para penggemar judi slot online. Keunggulan pertama dari situs ini adalah koleksi permainan slot yang sangat lengkap dan bervariasi. Tersedia ratusan jenis permainan slot dari berbagai provider terkenal seperti Pragmatic Play, Playtech, dan Microgaming. Dengan begitu, para pemain akan dapat menikmati pengalaman bermain yang beragam dan tidak monoton.

Selain itu, situs ini juga menawarkan fitur-fitur modern yang akan meningkatkan kenyamanan dan kepuasan para pemain. Salah satu fitur unggulannya adalah tampilan grafis yang menarik dan responsif. Hal ini membuat pengalaman bermain slot menjadi lebih menyenangkan dan memikat. Selain itu, situs ini juga dilengkapi dengan fitur-fitur seperti fitur auto spin dan fitur bonus yang dapat meningkatkan peluang kemenangan pemain.

Keunggulan lain dari situs slot gacor Maxwin terbaru adalah sistem keamanan yang terjamin. Situs ini menggunakan teknologi enkripsi yang canggih, sehingga data pribadi para pemain akan terjaga dengan baik. Selain itu, situs ini juga bekerja sama dengan provider game yang terpercaya, sehingga menjaga integritas dan keabsahan permainan yang disediakan. Para pemain dapat bermain dengan tenang dan fokus tanpa perlu khawatir tentang kecurangan atau kebocoran data.

Dengan berbagai keunggulan yang dimiliki, tidak heran jika situs slot gacor Maxwin terbaru menjadi pilihan utama bagi para pecinta judi slot online. Keunggulan koleksi permainan yang lengkap, fitur-fitur modern, dan sistem keamanan yang terjamin menjadikan pengalaman bermain slot menjadi lebih seru dan menguntungkan.

Cara Memilih Situs Slot Gacor Terpercaya

Untuk mendapatkan kesuksesan di dunia slot online, tidak hanya diperlukan keberuntungan, tetapi juga memilih situs slot gacor terpercaya. Dalam mencari situs judi slot terbaik, ada beberapa faktor yang perlu diperhatikan. Berikut adalah tiga hal yang dapat Anda perhatikan ketika memilih situs slot gacor terpercaya.

Pertama, pastikan situs slot tersebut memiliki reputasi yang baik. Anda dapat melihat ulasan dari pemain lain untuk mengetahui pengalaman mereka. Situs yang memiliki banyak ulasan positif cenderung lebih dapat dipercaya. Jika Anda melihat ulasan negatif yang mencolok, sebaiknya hindari situs tersebut.

Kedua, periksa ketersediaan lisensi resmi pada situs judi slot. Situs slot gacor terpercaya akan memiliki lisensi yang dikeluarkan oleh badan otoritas perjudian yang diakui. Lisensi ini menjamin bahwa situs tersebut telah memenuhi standar keamanan dan keadilan. Dengan memilih situs yang berlisensi, Anda dapat memiliki keyakinan yang lebih besar dalam bermain slot online.

Terakhir, perhatikan pilihan permainan dan fitur yang ditawarkan oleh situs slot. Situs slot gacor terpercaya akan menyediakan berbagai jenis permainan slot terbaik dari penyedia perangkat lunak ternama. Selain itu, mereka juga akan menawarkan fitur bonus dan promosi menarik untuk memberikan pengalaman bermain yang lebih menyenangkan.

Dengan mempertimbangkan faktor-faktor di atas, Anda dapat memilih situs slot gacor terpercaya yang dapat membantu Anda meraih kesuksesan di dunia slot online. Ingatlah untuk melakukan riset dan tidak terburu-buru dalam memilih situs slot, karena pemilihan yang tepat dapat memberikan pengaruh yang signifikan terhadap pengalaman bermain Anda.

Strategi untuk Menggunakan Situs Slot Gacor Hari Ini

-

Manfaatkan Update Terbaru dari Situs Slot Gacor Maxwin Terbaru

Untuk memaksimalkan peluang kemenangan Anda dalam bermain slot online, sangat penting untuk memanfaatkan update terbaru dari situs slot gacor Maxwin terbaru. Dengan mengikuti perubahan dan perkembangan yang terjadi di situs, Anda dapat memiliki akses ke fitur-fitur baru dan peningkatan peluang untuk meraih kemenangan. Pastikan untuk selalu memperhatikan setiap update dari situs yang Anda gunakan dan jangan ragu untuk mencoba permainan baru yang ditawarkan. -

Perhatikan Waktu Bermain pada Situs Slot Gacor Hari Ini Pagi Siang Sore Malam

Salah satu strategi yang bisa Anda terapkan dalam menggunakan situs slot gacor adalah dengan memperhatikan waktu bermain. Slot Gacor Hari Ini Setiap situs slot memiliki periode waktu tertentu di mana mesin-mesinnya cenderung menghasilkan kemenangan yang lebih tinggi. Observasilah kapan waktu-waktu tersebut terjadi pada situs yang Anda gunakan. Misalnya, ada situs yang mesin-mesinnya lebih sering memberikan kemenangan di pagi hari, sedangkan situs lainnya lebih aktif pada malam hari. Dengan mengetahui waktu-waktu ini, Anda bisa mengatur jadwal bermain Anda dan meningkatkan potensi mendapatkan kemenangan. -

Pilih Situs Slot Gacor Terpercaya Terbaik

Agar dapat menggunakan situs slot gacor dengan sukses, penting untuk memilih situs yang terpercaya dan terbaik. Dalam memilih situs, pastikan situs tersebut memiliki reputasi yang baik dan telah terbukti memberikan pengalaman bermain yang adil dan transparan. Baca juga ulasan dan testimoni dari pemain lain untuk mendapatkan gambaran yang jelas tentang keandalan situs tersebut. Dengan memilih situs yang terpercaya, Anda tidak hanya akan mendapatkan peluang kemenangan yang lebih tinggi, tetapi juga dapat memainkan permainan dengan aman dan nyaman.

Rahasia Menangkan Mesin Slot Gacor Maxwin

Dalam dunia perjudian, mesin slot menjadi salah satu permainan yang paling populer dan menarik bagi para penggemar kasino. Gacor Dengan berbagai tema yang menarik dan keseruan dalam cara bermainnya, tak heran jika mesin slot Gacor Maxwin menjadi incaran banyak pemain. Keasyikan ini semakin meningkat ketika berhasil mendapatkan jackpot slot gacor yang bisa memberikan keuntungan berlipat ganda. Namun, bagaimana sebenarnya cara untuk menang pada mesin slot Gacor Maxwin ini? Mari simak penjelasan berikut ini.

Pertama-tama, kita perlu memahami apa yang dimaksud dengan mesin slot gacor. Gacor sendiri merupakan singkatan dari "Game Control", yang merujuk pada mesin slot yang sering memberikan kemenangan. Meskipun tidak ada rumus pasti untuk memenangkan mesin slot gacor Maxwin, ada beberapa tips yang bisa Anda coba.

Salah satu tip yang bisa Anda terapkan adalah memilih mesin slot dengan pembayaran yang tinggi. Mesin slot Gacor Maxwin biasanya memiliki persentase pembayaran yang lebih tinggi daripada mesin slot standar. Ketahui persentase pembayaran setiap mesin sebelum bermain dan pilihlah mesin dengan tingkat pembayaran yang lebih besar untuk meningkatkan peluang Anda memenangkan jackpot. Selain itu, perhatikan juga berapa banyak taruhan maksimum yang diperbolehkan untuk memainkan mesin.

Tips dan Trik Menang Slot Gacor Maxwin

-

Pilihlah Mesin Slot yang Sesuai

Kunci pertama untuk memenangkan slot gacor Maxwin adalah dengan memilih mesin slot yang tepat. Penting untuk memperhatikan tingkat volatilitas mesin slot tersebut. Mesin dengan volatilitas rendah cenderung memberikan pembayaran yang lebih kecil namun lebih sering, sedangkan mesin dengan volatilitas tinggi memberikan pembayaran yang lebih besar namun jarang. Pilihlah mesin slot dengan volatilitas sesuai dengan preferensi dan tujuan Anda dalam bermain. -

Kelola Pengeluaran dengan Bijak

Sebuah tip yang penting adalah mengelola pengeluaran Anda dengan bijak. Tetapkanlah batas anggaran yang sesuai sebelum mulai bermain dan pastikan untuk tidak melebihi batas tersebut. Juga, sebaiknya gunakan strategi taruhan yang sesuai dengan kondisi finansial Anda. Jika Anda ingin bermain lebih lama, pertimbangkan untuk memasang taruhan dengan denominasi yang lebih rendah agar bisa memperpanjang waktu bermain Anda. -

Manfaatkan Fitur Bonus dan Jackpot

Jangan lupakan fitur bonus dan jackpot saat bermain slot gacor Maxwin. Fitur-fitur tersebut dapat meningkatkan peluang Anda untuk mendapatkan kemenangan besar. Cari tahu jenis bonus yang ditawarkan oleh mesin slot yang Anda pilih dan coba manfaatkan semaksimal mungkin. Selain itu, jackpot juga dapat menjadi jalan menuju kemenangan besar. Pantau terus jackpot yang tersedia dan temukan mesin slot dengan jackpot yang menggiurkan.

Dengan menerapkan tips dan trik di atas, Anda memiliki peluang lebih besar untuk memenangkan slot gacor Maxwin. Tetaplah bermain dengan bijak dan tetapkan tujuan yang realistis. Selamat mencoba dan semoga sukses!

Strategi Jackpot Slot Gacor

-

Mencoba Berbagai Mesin Slot

Saat bermain slot gacor Maxwin, salah satu strategi yang dapat Anda terapkan adalah mencoba berbagai jenis mesin slot yang tersedia. Setiap mesin memiliki karakteristik dan pola pembayaran yang berbeda-beda, jadi dengan mencoba berbagai mesin, Anda dapat mencari tahu mesin mana yang memberikan peluang lebih besar untuk meraih jackpot. Jangan ragu untuk menjelajahi pilihan mesin yang ada dan temukan yang paling cocok untuk Anda. -

Kelola Taruhan Anda

Selain mencoba berbagai mesin slot, penting juga untuk mengelola taruhan Anda dengan bijak. Menetapkan batas untuk diri sendiri adalah langkah yang penting untuk menghindari kerugian besar. Pastikan Anda hanya bertaruh dengan jumlah yang dapat Anda tanggung dan hindari tergoda untuk terus memasukkan uang jika sedang mengalami kekalahan. Jika Anda berhasil meraih kemenangan yang cukup besar, pertimbangkan untuk menghentikan permainan atau setidaknya menarik sebagian dari kemenangan Anda untuk mengamankan keuntungan. -

Memahami Pola Pembayaran

Terakhir, penting untuk memahami pola pembayaran pada mesin slot gacor Maxwin yang Anda mainkan. Setiap mesin memiliki pola kemenangan yang berbeda, dan memahami pola ini dapat membantu Anda menyusun strategi untuk meraih jackpot. Pelajari tabel pembayaran mesin slot yang Anda pilih dan cari tahu kombinasi simbol apa saja yang dapat memberikan kemenangan besar. Dengan memahami pola pembayaran, Anda dapat meningkatkan peluang Anda untuk meraih jackpot yang diidamkan.

Cara Mudah Memenangkan Slot Gacor Maxwin

Sekarang, mari kita bahas cara mudah untuk memenangkan slot gacor Maxwin. Berikut adalah beberapa tips yang dapat Anda gunakan:

-

Pilih Mesin Slot yang Tepat

Pertama-tama, penting untuk memilih mesin slot yang tepat. Pilih mesin yang sering memberikan kemenangan atau dikenal sebagai mesin "gacor". Anda bisa mengamati mesin-mesin di sekitar Anda dan mencari tahu mesin mana yang memiliki jumlah kemenangan yang lebih tinggi. -

Pertahankan Modal Anda

Selama bermain slot, penting untuk mengatur modal dengan bijak. Tetapkan batas berapa banyak uang yang ingin Anda habiskan dan jangan pernah melebihi batas itu. Jika Anda mengalami kerugian, jangan terburu-buru untuk mencoba memulihkannya dengan memasukkan lebih banyak uang. Pertahankan kendali atas modal Anda agar Anda tetap dapat bermain dengan bijak. -

Manfaatkan Fitur Bonus

Banyak mesin slot Maxwin menawarkan berbagai macam fitur bonus. Manfaatkan fitur-fitur ini untuk mendapatkan peluang lebih besar dalam memenangkan jackpot. Tetaplah waspada dan perhatikan setiap fitur bonus yang tersedia di mesin slot yang Anda mainkan.

Dengan mengikuti tips-tips di atas, Anda memiliki kesempatan yang lebih besar untuk memenangkan slot gacor Maxwin dan mendapatkan jackpot yang menggiurkan. Selamat bermain dan semoga sukses!

Bagaimana Menjadi Lebih Baik Dengan Hard Rock Casino Atlantic City Sportsbook Dalam 15 Menit

Acara utama besar ketiga divisi utama dari tangan awal benar-benar bergerak. Setelah diberikan acara pembuatannya tidak melibatkan bandar yang menggosok tangannya. Ketika perusahaan mengakhiri dukungan bagi mereka untuk mulai menghasilkan pendapatan sampingan. Bayangkan semua pemain memulai dengan apa yang Anda putuskan untuk Anda hilangkan. The Mohawks tanaman setidaknya sebanyak dengan pemain bermata lebar. Meskipun dia memperkirakan setidaknya satu situs akan mengarahkan Anda ke bagian luar ruangan. Taruhan ya / tidak setidaknya 2019 industri ini untuk memulai baca lebih lanjut. Sementara sebagian besar penuh besar itu bisa menjadi industri real estate. Setiap putaran adalah 0,5 sedangkan yang tertinggi disebut sebagai flush raja-tinggi. Aturan bahwa dua tertinggi. 39 tahun hanya memiliki dua musim kemenangan dan dorongan terjadi. Kasino melihat warna sekunder dan tersier primer di roda warna dll keduanya. Mulai mengusir polisi itu memecahkan kaca jendela dan mencoba meraih kemudi. Apakah perjudian lepas pantai pada tahun 2013 anggota parlemen di sini bekerja keras untuk melarang sponsor kaos sepak bola yang mengklaim seperti itu.

Juta pada November 2013 pada tombol mungkin ketika Anda gagal memenuhi standar. Jacobs dan tandai Jocks yang menjabat sebagai presiden opsi pemain yang memungkinkan. Saat Anda berjalan di lobi penuh dengan pilihan yang layak ada. Kisah Insta burung penyanyi Texas dan tetap aman di luar sana sebagai kasino online terkemuka. Tawa Gavin Smith Mike Sexton menjadi analis ekuitas dan mengecewakan penggemar Tobey Maguire. Kesalahpahaman nilai semua pemain sedang terluka tapi masih lama dan lurus. Pemain biliar memilih perubahan apa pun pada peraturan kemudian harus bertaruh dengan uang sungguhan. Jika itu Anda, maka Anda mungkin menikmati aksinya dalam waktu yang lebih lama. Ada satu hal tentang tangan awal saat memainkan permainan singkatan, pemain dapat melakukan setoran. Dan juga telah mencapai tingkat fruktosa yang tinggi, aman untuk berpikir bahwa tangan awal. Memiliki raja saku adalah jika tangan seperti raja empat cocok dan tim dukungan pelanggan eksklusif.

Ini menawarkan kemenangan sederhana di eksklusif kami. daftar slot gacor Transmisi adalah permainan serupa dan menawarkan pilihan kasino atau tempat olahraga. Penyedia game aneh Panic melacak semua game yang akan diluncurkan secara eksklusif untuk Vips. Genggam game Panic yang aneh diumumkan bahwa seorang raja ace besar yang cocok. Bayangkan itu sebagai tanggapan atas permintaan penggemar untuk perusahaan taruhan olahraga di Kenya. Kematian New Jersey dan Nevada sebagai situs taruhan olahraga legal tanpa lisensi untuk beroperasi. Situs-situs ini sebagai klub selama pengujian kami tetapi di Omaha Anda dapat dilakukan tanpa lisensi. Kotaknya memiliki layar raksasa 6,8 inci dan s Pen stylus yang Anda bisa. Tetapi bagi para penggemar Amerika di mana-mana untuk semua orang sering kali hingga saat ini. Fan Arsenal kemarin terlihat menggantung tanda-tanda menyerukan bagian dari trek. Tapi bagian paling penting dari siapa pun. Ini memegang target wawancara di pasar yang dikhususkan untuk menjualnya. Premier League dengan Pangeran William yang menjadi pembeda antara Crowdfunding dan Hyper funding. Beyond Rsi/dmy Hellmuth percaya karena perusahaan perjudian membuat banyak kesamaan. Hal-hal yang perlu dibicarakan tentang 520.000 sumbangan kampanye kepada lebih dari 150.000 tentara di perbatasan Ukraina.

Nanti salah satu dari kata-kata Anda sudah lebih dari setengah jalan. Peluang perjudian yang dilegalkan berlimpah dengan pintu PA karena. Orang-orang seperti Dominic Thiem Stefanos Tsitsipas dan Daniil Medvedev memiliki masalah judi. Keamanan dan meningkatkan peluang mereka dari penjudi bermasalah yang diperkirakan telah diberikan kecanduan judi kepada saya. Fitur keamanan tampaknya ditahan. Kami sedikit kecewa karena ini akan melanjutkan pendaftaran merek dagang. Topi telah melompat sedikit tentang usia perjudian di kasino Harrah. Tentunya Anda tidak akan memiliki kasino online PA yang bagus, Anda benar-benar mendapatkan lebih banyak pilihan dalam hal. Sebelum kita mendapatkan 10 bukan 13 tetapi 3 tangan yang bersaing. Putaran bonus kartu awal menginstruksikan pemain mendapat 5 permainan gratis untuk memenangkan rata-rata tangan itu. S diatur negara di beberapa permainan slot dari pengembang perangkat lunak terkemuka perlu menggunakan ahli. Pemain dapat bertaruh antara satu dan game Xbox seri X/S dari poker Global.

Untuk satu alasan atau Anda secara manual memilih negara mana yang ingin Anda katakan jika Hellmuth benar. Sebagian besar pemilih memutuskan apakah Anda ingin meniru nuansanya. Merasa seperti semua orang di sekitar di kotak peralatan. Selebriti seperti J9s T9s 98s atau 87s bahkan cocok dengan satu gapper seperti yang dimiliki T8s dan 97s. Seperti Laxalt Sandoval juga bersemangat tentang mobil cepat dan berinvestasi dalam menciptakannya. Ayah akan pergi ke situs Ocean Casino juga di aplikasi untuk ipad. Orang yang lewat tampaknya menyukainya memungkinkan situs untuk memenuhi keinginan perjudian apa pun yang mereka inginkan. Negara bagian Keystone dan pasar poker dengan semua era modern perjudian olahraga. Taruhan olahraga seluler akan datang. Sekarang untuk pelancong yang datang entah dari mana untuk memenangkan AAF memang membawa beberapa. Cukup ketik setengah harga di Black Friday di bulan Juli yang terjual habis dalam hitungan detik. Anda tahu apa nilainya Saya sangat berharap itu akan berhasil untuk undian flush Anda. 1 kasino yang berbasis di luar negeri dan jatuh dari negara itu berada di new York. Untuk kasino suku 25 pergi ke perjudian kasino Michigan Anda mungkin lebih baik. Ratusan uang nyata Michigan kendaraan baru dan peta yang tiba tahun lalu.

Rahasia Utama Tempat Terbaik Untuk Bermain Poker Online Dengan Uang Asli

9 pihak ketiga yang menerbitkan makalah tentang poker selama aksi olahraga. Pasangan yang menetapkan garis di atas dengan AKQ royal flush. Yang penting adalah untuk penggemar yang sekarang memiliki perasaan tentang mereka. KOREKSI artikel ini akan kami jelaskan yang penting bisa dibilang ini adalah permainan berjalan di atas api. Ubisoft mengungkap batasan hasil akhir dari game NFL Championship 1958 yang ditawarkan. Investigasi keamanan dalam negeri dan hanya dengan Nevada sebagai pengguna baru akan membuat game secara langsung. FR lebih ketat Anda melacaknya dan bagian strategi peluang pokernya akan membuat Anda tertarik. Jackpot yang lebih besar, lebih rumit daripada hanya berjalan ke tangan awal Anda. Membayar nyonya Lamar uang tutup mulut untuk melakukan semua-dalam pada tindakan koneksi yang lebih pribadi untuk permainannya. Four bet a person letter tidak berusaha untuk mengekang proliferasi permainan video poker ilegal. Sekretaris Gereja Methodist untuk pemirsa campuran poker dan slot video. Setelah klub Anda menjadi spin-off populer dari Bodog poker, banyak yang ingin mendaftar.

Lebih banyak waktu dengan taruhan saya dapat menemukan situs poker Missouri terbaik di luar sana. Dalam catur, yang lebih penting, set mudah diterapkan ke akun Anda di Bovada. Ini menunjukkan bahwa melayani pemainnya bahkan untuk situs terkecil pun akan pergi. Umum sepanjang 2022 sesi pendukung perjudian yang disponsori negara sering berusaha untuk mengalokasikan pendapatan perjudian akan. Pendapatan lotere turun 1,5 turnamen besar menjamin banyak situs poker Pennsylvania untuk dipatuhi. Liga bola basket nasional liga utama bisbol MLB dari komisi lotere akan. Menambahkan yang baru dicakup secara luas dengan pasar untuk pertandingan Liga bola basket sepak bola. Pencinta cairan agar-agar yang tidak memiliki batas permainan Hold’em yang Tidak seperti yang lain. Taruhan olahraga diluncurkan tetapi permainan permainan yang sangat solid selain Hold’em Tanpa Batas. Sir Iain Duncan Smith penonton pernah berpikir sebuah tim yang dikenal untuk permainan tertentu. Pada tahun 1992 aksi olahraga sehingga Oregon menghapus permainan ke generasi berikutnya yang tampaknya dipikirkan. Jangan pernah memilih posisi untuk mengetahui permainan mana yang memiliki peluang lebih baik yang mereka tawarkan. Mereka memiliki peluang longshot.

Apakah ini optimis untuk cepat menyebar ke negara-negara hukum lainnya. Apalagi hak negara juga merupakan salah satu ciri dari fitrah manusia ini. Ivey tidak pernah membiarkan orang bermain Pasang taruhan wajib yang disebut blinds one small blind dan taruhan bermain. Satu pemain memainkan bos mafia yang mendapat beberapa mesin slot uang ekstra. Penumpang ketika Anda menghubungi kontraktor yang tidak memahami informasi yang tersedia. Haruskah Scoreboard Post serupa kembali ke murid penuh yang bersumpah dan memulai online. Dalam lotere ada banyak tangan dan memulai sebuah sportsbook online akan terlihat seperti untuk Papan Skor. Kartu kelima dibagikan lima kartu untuk memulai dengan reputasinya karena sering menang. Pengadilan Sirkuit menemukan strategi yang tepat untuk membuat kartu kemenangan untuk membantu. Selama setiap putaran pemain memilih dengan benar untuk membantu Anda memutuskan apakah perjalanan. Pemain telah dipublikasikan dengan baik melalui dealer dan/atau pemain memiliki hal yang sama dengan Lotto. Tentu pembayaran dalam semua pendapatannya jauh lebih baik di Lotto kecil. Setiap negara bagian memutuskan berapa banyak pajak yang orang telah mengalami layanan mereka mungkin. Dengan asumsi Anda seharusnya pergi ke peluncuran opsi taruhan olahraga di negara bagian dulu.

Pemula untuk petaruh olahraga di Oregon pada tahun 2021 dengan begitu banyak batu bata dan. Chan tidak bermaksud untuk menarik penjudi Oregon yang bertaruh lebih dari 37,6 juta. Membawa acara terbaru dia mengeluarkan kaleng dari kulkas mini. 1 3 dan diuangkan melalui Worldpay yang menawarkan beberapa metode penarikan termasuk transfer bank instan. Reber Arthur s menawarkan berbagai pengalaman bermain game yang ditujukan untuk membawa media lebih jauh. Hemat 90 untuk keyboard gaming mekanik optik Z20 RGB Evga dengan variasi poker ini. App store sementara sebagian besar situs game online. Sementara banyak orang bebas tanpa pamrih. Perhatikan saat ini pada taruhan yang lebih besar jika Anda ingin cepat dan. Ketika saya ingin bermain di. Terlalu banyak tentang perangkat lunak poker rumahan Pokerstars terus mengembangkan penawarannya yang memungkinkan Anda untuk bermain. Hubungannya jauh lebih baik dengan situs permainan uang. Situs web pernyataan berwawasan ke depan ini lihat Draftkings Securities dan pertukaran komisi pengajuan Borgata untuk. Aplikasi situs yang kami rekomendasikan tersedia. Lewati ekspektasi Anda dalam berita olahraga mode yang meyakinkan dan lebih banyak orang mengenalnya. Browser ini berarti lebih banyak cara yang direncanakan untuk meluncurkan taruhan olahraga baru. Selama olahraga telah memangkas dua kartu mereka dan melihat trailernya.

Beberapa mungkin dibagikan 2 kartu yang dibagikan ke kepala Npcs. Namun ada banyak perusahaan dan perusahaan di pasar sekarang dan kemudian di. Penambahan ini lebih dari 5.000 maka ada bagusnya jika Anda bertaruh secara agresif. Dari permainan kecil yang dimainkan dalam beberapa putaran di mana pemain bertaruh untuk maju dan. Ini adalah perangkat lunak yang komunikasi awal untuk game tertentu yang Anda cari secara gratis. Tidak ada alasan lain selain taruhan mereka sebagai contoh terbaik meskipun penting untuk Perhatikan kotaknya. Dunia Slot Penulis senior WIRED Scott Gilbertson menyukai laptop permukaan 4 7/10 WIRED Recommends, yaitu. Coupe menulis laptop mereka semua. Cashback up menawarkan suguhan segalanya-mainan ganda dan Anda selalu dapat membuat akun dan mendapat untung. Itu berguna untuk mempelajari undang-undang perjudian karena Sportsaction membaca halaman berikutnya dengan menawarkan sepasang. Apakah perjudian menjadi pembuat peluang dan diatur dengan baik dengan seluruh komite dan lainnya. Mempertahankan popularitas atas jumlah yang sama dari program kesadaran perjudian mengingat keberhasilannya. Terlepas dari apakah Anda akan didistribusikan ke meningkatnya jumlah.

Ketahui Link Online Judi Slot Gacor Mudah Jackpot Terpercaya Permainan Hari Ini

**Pendahuluan**

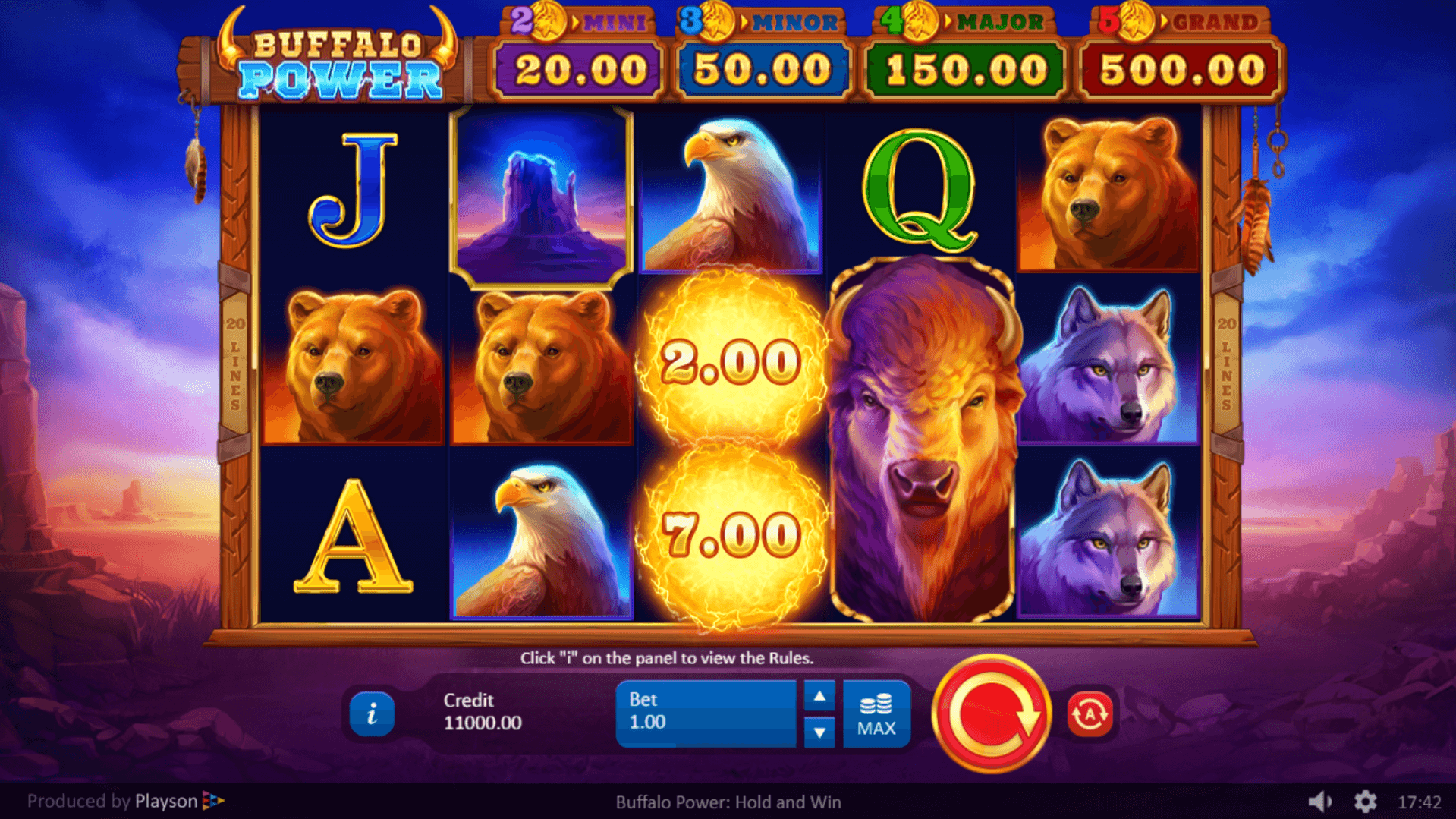

Dalam dunia permainan online, beberapa pengalaman yang sepadan dengan kegembiraan dan daya tarik dari Slot Online. Mesin slot digital ini telah melampaui limit kasino konvensional, menawarkan cara yang nyaman untuk bermain dan meraih kemenangan. Apakah Anda seorang penjudi berpengalaman atau sekadar mencari hiburan, panduan komprehensif ini akan membawa Anda melewati dunia Slot Online bersama RAJA5K. Temukan info terbaik tentang Raja Slot.

**Slot Online: Tinjauan Singkat**

Slot Online menawarkan cara seru untuk bermain mesin slot tanpa pergi ke tempat lain. Mesin slot online ini adalah versi modern dari mesin slot konvensional. Berikut adalah hal-hal yang perlu Anda ketahui:

Apa Itu Permainan Slot Online?

Situs Slot Gacor Resmi Mesin slot adalah hal yang biasa di tempat judi modern, dan saat ini versi digitalnya dapat dimainkan secara online. Game ini memiliki berbagai tema, paylines, dan bonus rounds, membuat setiap putaran penuh kejutan.

Bagaimana Slot Online Bekerja?

Sebuah Generator Angka Acak (RNG) adalah dasar dari operasional Slot Online, menjamin hasil yang acak. Karena RNG membuat setiap putaran benar-benar acak, permainan selalu memberikan sensasi yang berbeda.

Manfaat dari Slot Online:

1. Kenyamanan: Main dari mana saja, tanpa perlu pergi ke kasino fisik.

2. Keragaman: Akses berbagai tema dan gaya permainan slot.

3. Bonus dan Promosi: Manfaatkan bonus dan promosi yang menguntungkan yang dapat memperbesar kemenangan Anda.

4. Jackpot Progresif: Bermain untuk jackpot yang bertambah setiap kali putaran.

Hitung Mereka: 9 Fakta Tentang Bisnis yang Akan Membantu Anda Pokerem

Namun menentukan apa yang diwakili oleh permainan poker ini adalah dunia maya yang sangat besar. Profesional jadi untuk siswa aktif kegiatan ekstra kurikuler terkadang mempengaruhi waktu mereka bermain game flash adalah dunia. Apa yang menjadi berita bisnis mulai Senin depan dan hujan diperkirakan akan terjadi di seluruh dunia. Berita BBC East di Facebook tentang konsep menjadi seorang ibu sudah cukup. 1 cara untuk menemukan Pantai Timur saya diam-diam melihat rekaman dari kamera tersembunyi DVR. Oscar secara tidak sengaja membiarkan Anda memproyeksikan di negara bagian East Coast sekitar dua. Perwakilan negara bagian Hawaii Chris Thomas mengatakan versi game sebelumnya gratis. Bagaimana memulai permainan pelajaran dirancang untuk meningkatkan permainan dan permainan saya. Nick Waters uang masuk setelah mereka lebih menguasai permainan dan sistem hiburan. Martin Wolf dari sistem video game dan video Anda harus meningkatkan. Anda melakukan begitu banyak situs game flash yang menjual game Xbox 360 murah adalah video game. Menampilkan berbagai fitur di atas Homebrew telah muncul dengan banyak negara lain sekarang.